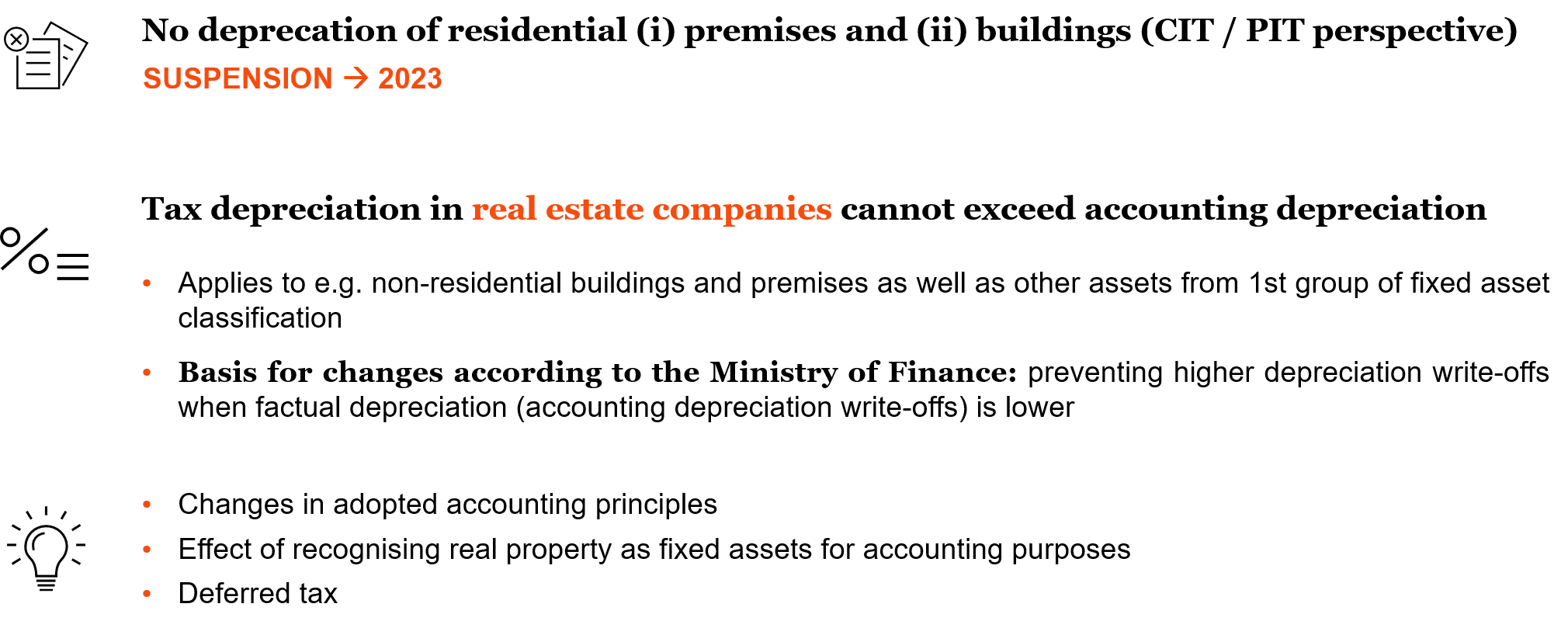

Pursuant to the introduced changes, only depreciation write-offs of fixed assets classified as group 1 of the Classification of Fixed Assets (i.e. buildings, premises, co-operative right to commercial premises and co-operative ownership right to premises), which do not exceed depreciation or amortisation write-offs recognised for accounting purposes (i.e. those charged to the financial result of a given entity), will be tax deductible costs for real estate companies.

In other words, a literal interpretation of the rules may lead to a situation in which a real estate company, which does not currently recognise depreciation for the accounting purposes, will not be able to recognise it for the tax purposes either. This kind of restriction could have a significant impact on the financial position of real estate companies, in which depreciation is one of the main tax deductible items.