What’s going to change?

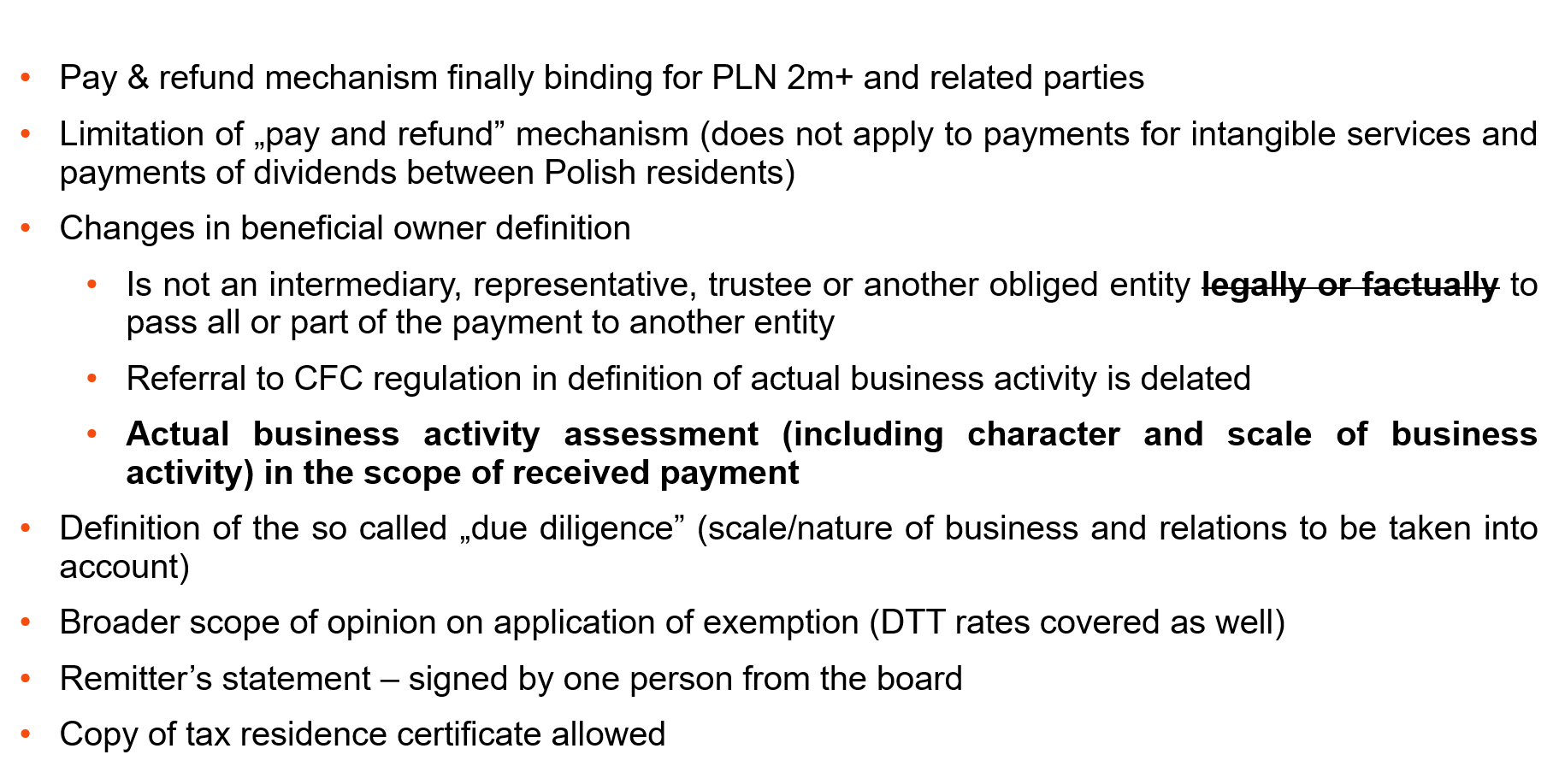

As of 1 January 2022, Polish remitters may be obliged to collect 19% or 20% WHT under a new “Pay and Refund” procedure irrespective of the relevant wording of double tax treaties or implemented EU Directives.

The “Pay and Refund” mechanism could apply to payments made to related parties for interest, royalties or dividends and would be applicable on the excess of approx. EUR 400k per taxpayer / per year.

For certain payments (irrespective of their value), a business substance based definition of beneficial owner could apply and thus should be verified.

A switch-over rule to treat certain payments as “in-scope” of the WHT pay and refund mechanism is also provided, and may, i.a. concern certain dividend-like income distributions or payments made for intangible services.

Due diligence of the tax remitter will be necessary to maintain to benefit from any WHT tax relief, but for payments subject to the “Pay and Refund” procedure, WHT relief will only be possible provided that a specific tax ruling is obtained, or Board members sign a specific statement – under pain of fiscal penal sanctions.

Summary of key changes in Pay and Refund Mechanizm