The most significant changes

The Polish Deal will affect the entrepreneurs running a sole proprietorship to a significant extent.

The most significant changes are listed below:

Change in the basis for health care contributions and elimination of the possibility of deducting health insurance contribution from tax

Heretofore, entrepreneurs paid the health insurance premium on the declared basis for the assessment of contributions. As a result of the planned changes, from 2022, the contributions will depend on income or a specific basis of assessment, subject to the selected form of taxation and the amount of annual gross income.

Moreover, in the case of entrepreneurs who tax their income at flat tax rate, the health insurance contribution would be 4.9%. After these changes take effect, it will no longer be possible to treat a portion of the health insurance contribution as a tax-deductible.

Reduction of lump sum tax rates on recorded revenues

The Polish Deal assumes a reduction of the lump sum tax rates on the recorded revenues for some types of business activities:

- to 12% on services involving the release of software packages and computer hardware advisory services and software-related services,

- to 14% on rendering services in health care, architecture and engineering services, technical research and analysis services, and in the field of specialized design

Restriction of the right to use a tax card

From January 1, 2022, the tax card will be an available form of taxation only for individuals applied it before that date. Therefore, new entrepreneurs will not be able to use this form of taxation

Who would be affected by the changes?

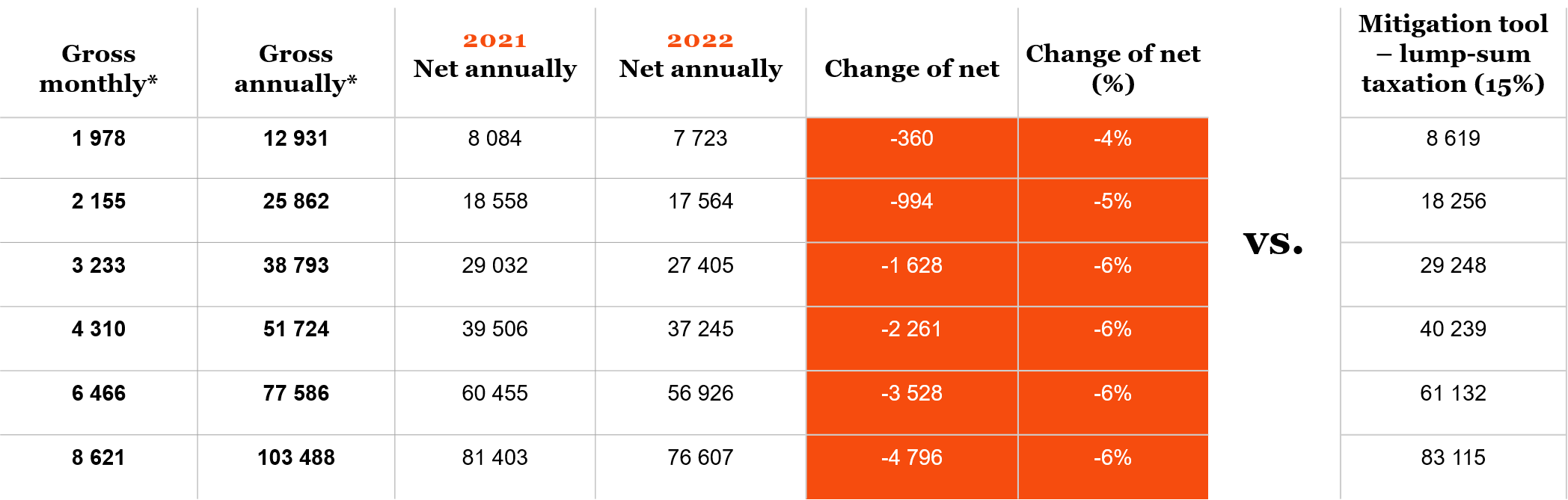

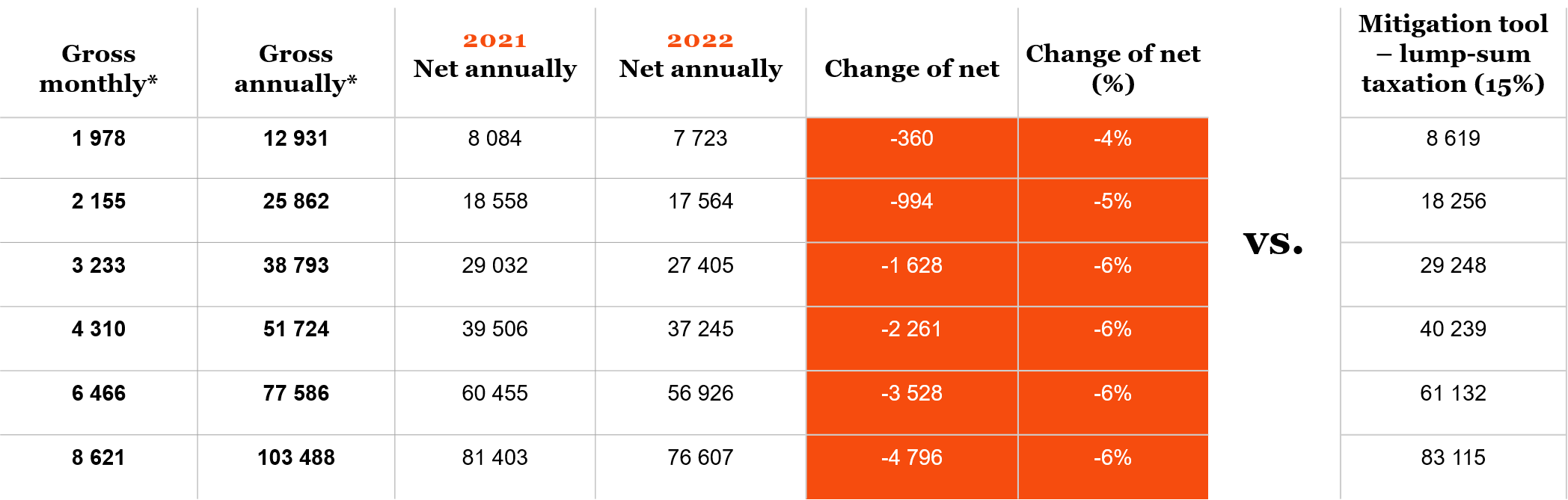

The changes will have a negative impact on all entrepreneurs. Nevertheless, entrepreneurs will still have the right to choose the form of taxation, some of which may be more favorable than others. These changes will be particularly burdensome for individuals running a business that generates significant income.

Changes for entrepreneurs (B2B) – flat tax rate 19% and lump-sum taxation

*Net of VAT

** Amounts are presented in EUR with NBP average rate as at 1.12.2021 being 4,64 PLN = 1 EUR