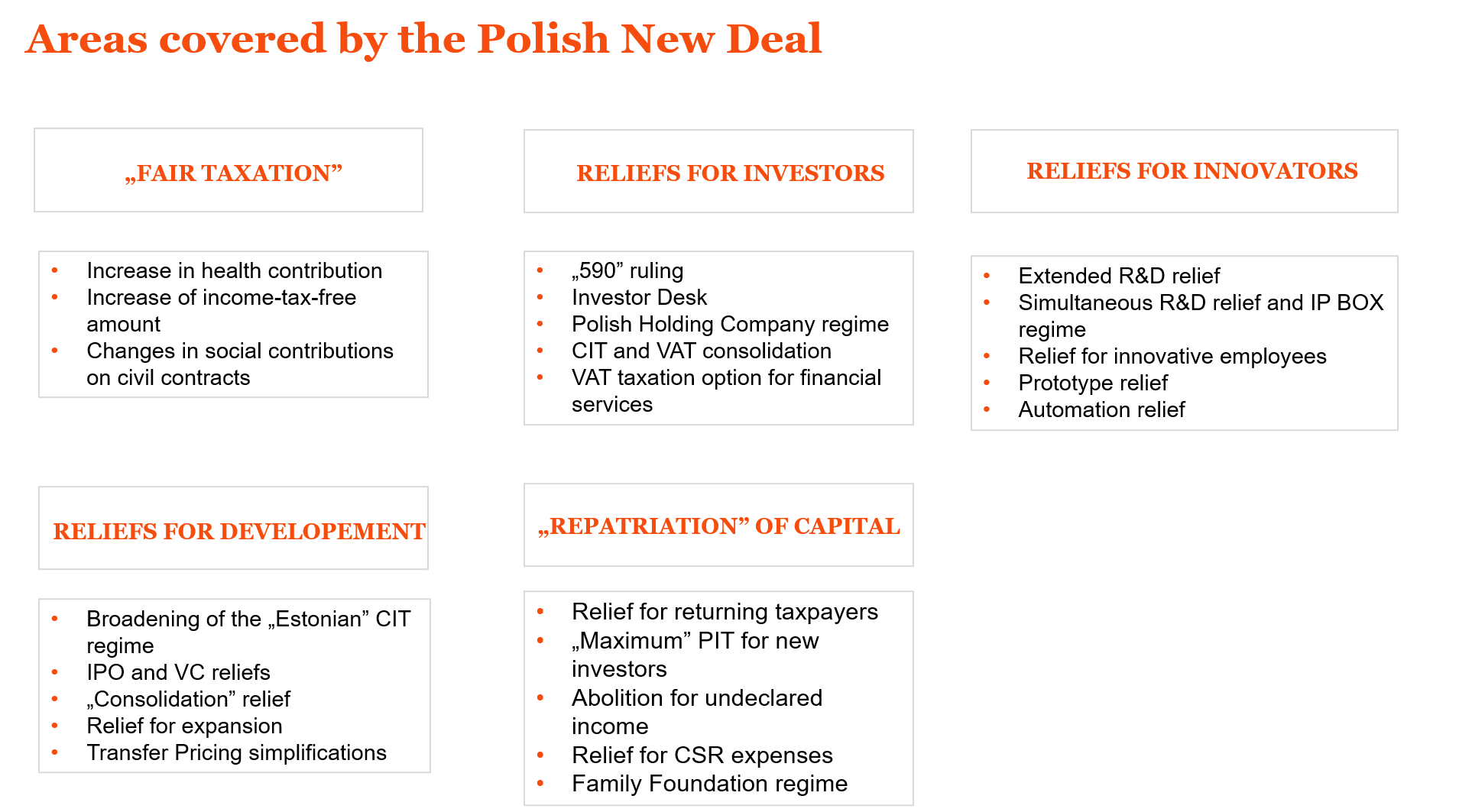

#PolishNewDeal: new innovation package, more details revealed

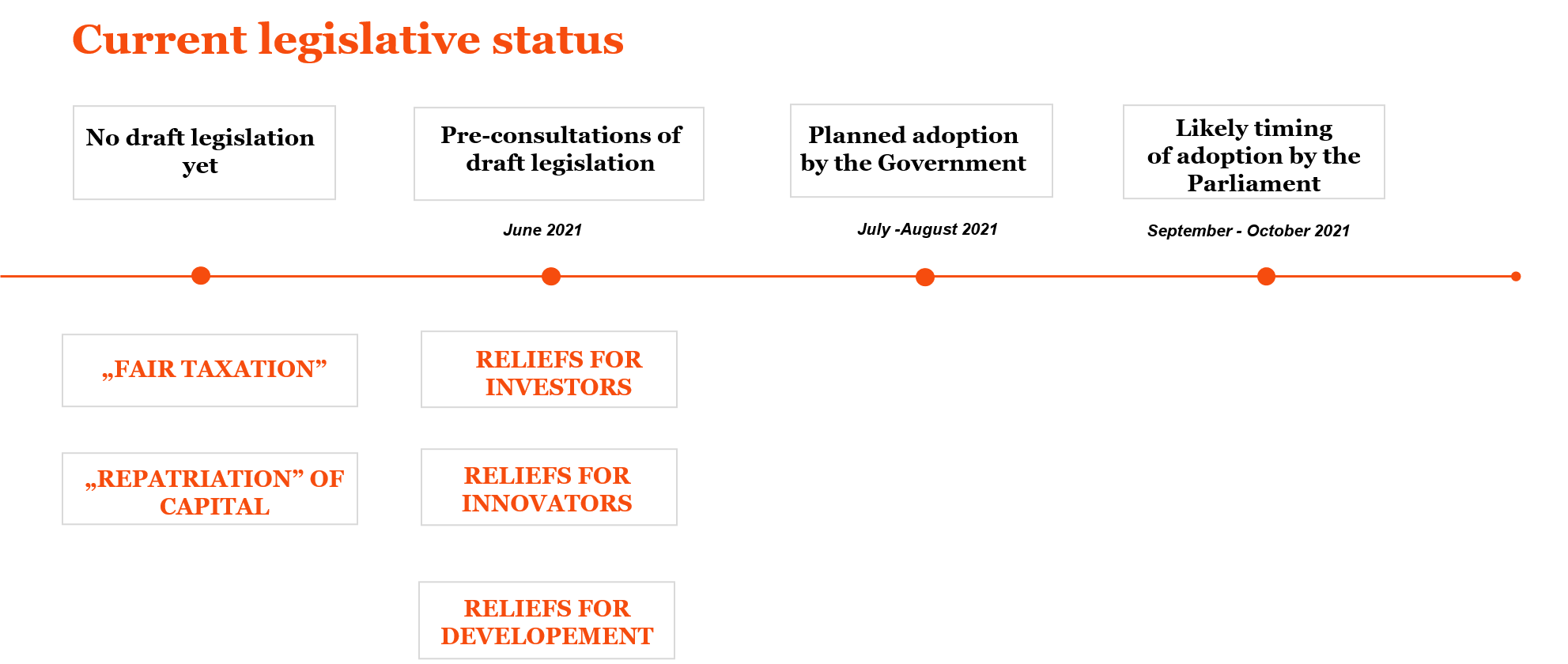

On 15 June, within public pre-consultations, the proposal of regulations extending existing tax reliefs related to R&D activities was published on the MoF website. Unfortunately, the assumptions on the robotization relief have not yet been revealed.

The new innovation package (in the version as proposed so far) refers only to part of tax reliefs planned to be introduced (i.e., a relief for a prototype, a relief for innovative employees, the possibility to use the IP Box and R&D relief simultaneously for the same income). Additionally, what has not been announced before, the proposed regulations extend the application of the already functioning R&D relief. Importantly, the currently proposed solutions do not make the application of the abovementioned incentives dependent on the size of taxpayer’s enterprise.

Below we present a short summary of the key proposals of the new innovation package.

| Type of relief | Description of relief | Key changes/assumptions |

| Extension of R&D relief |

This relief has been in place since 2016 and enables the settlement of tax costs incurred by the taxpayer for R&D activities. |

|

| Introducing relief for the prototype |

Possibility to deduct expenses incurred for trial production of a new product or its introduction to the market from the tax base. |

|

| Introducing tax relief for innovative employees | Possibility to deduct the unsettled R&D relief as part of advance PIT payments from the salaries of employees directly involved in R&D works. |

|

| Introducing the possibility of simultaneous use of IP BOX and R&D relief | The possibility to settle R&D relief within income benefitting from IP BOX. |

|

According to information provided, the new solutions should enter into force beginning from 2022.

The proposed innovation package does not yet include the wording of provisions related to the relief for robotization (automation). Nevertheless, general information from the MoF indicates that it is still planned to be introduced.

Listen