What does it mean?

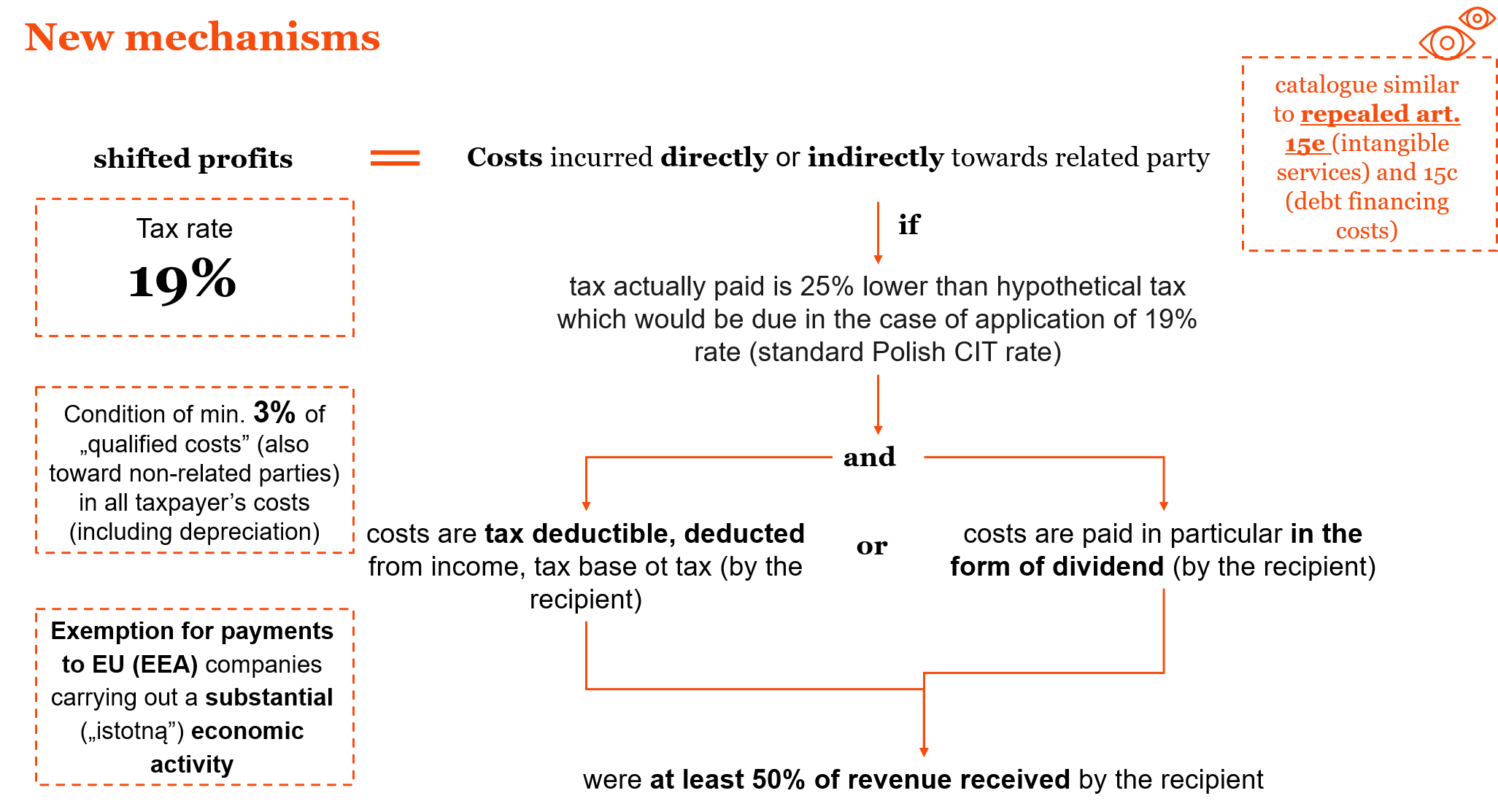

If given stream of payment is considered “shifted profit”, Polish company may be obliged to pay 19% CIT on its value (certain deductions are possible e.g. paid WHT)

Exclusion concerns however a payment recipient being tax resident in EU / EEA jurisdiction, provided that he conducts in its resident country significant genuine business activity.

In practice new provisions may be in particular burdensome for companies from Switzerland, UK or USA (and other non-EU/EEA countries). At the same time vague wording, of the provisions will require case by case analysis to properly asses the final impact.