Who would be affected by the changes?

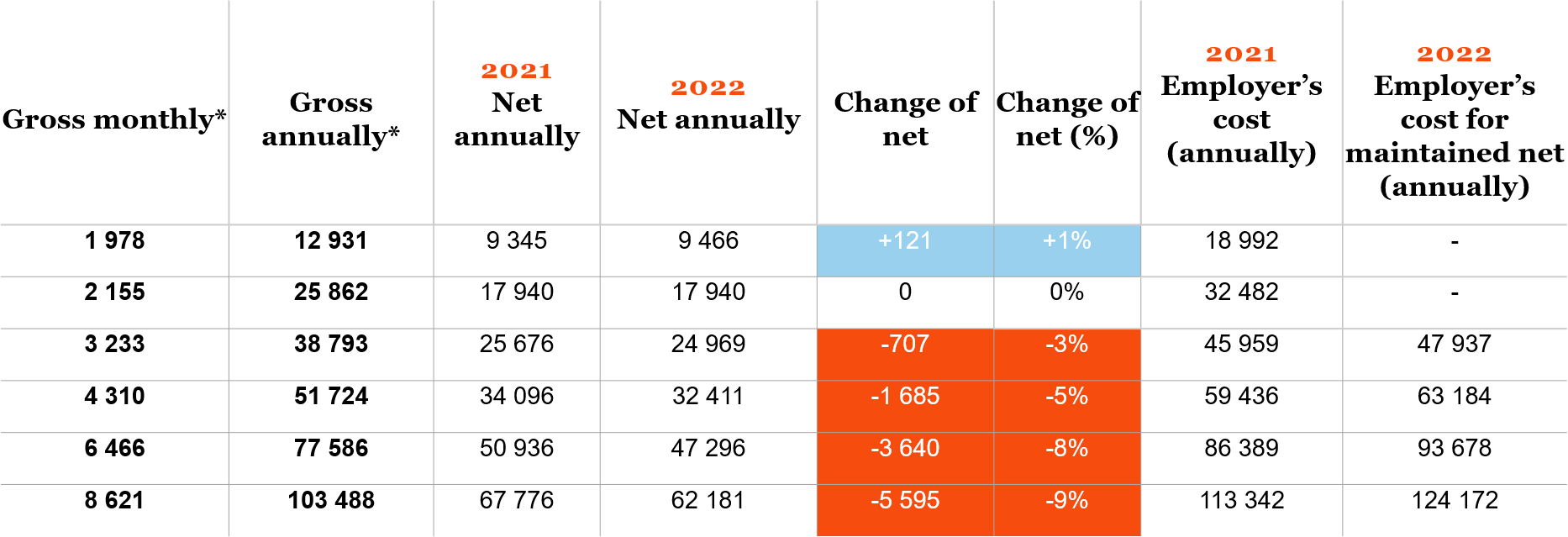

The changes will be beneficial or neutral for employees earning up to about PLN 13,000 gross a month. For other employees, the new regulations mean a reduction in net salary. This will that both Employees and Employer will lose out. In addition, the new regulation does not provide for changes that would increase the financial burden on the part of employers. Nevertheless, wage pressure may appear in many industries, which will result in the need to raise wages by the Employers.

*Estimated ZUS CAP for 2022 – EUR 38 276

**Amounts are presented in EUR with NBP average rate as at 1.12.2021 being 4,64 PLN = 1 EUR