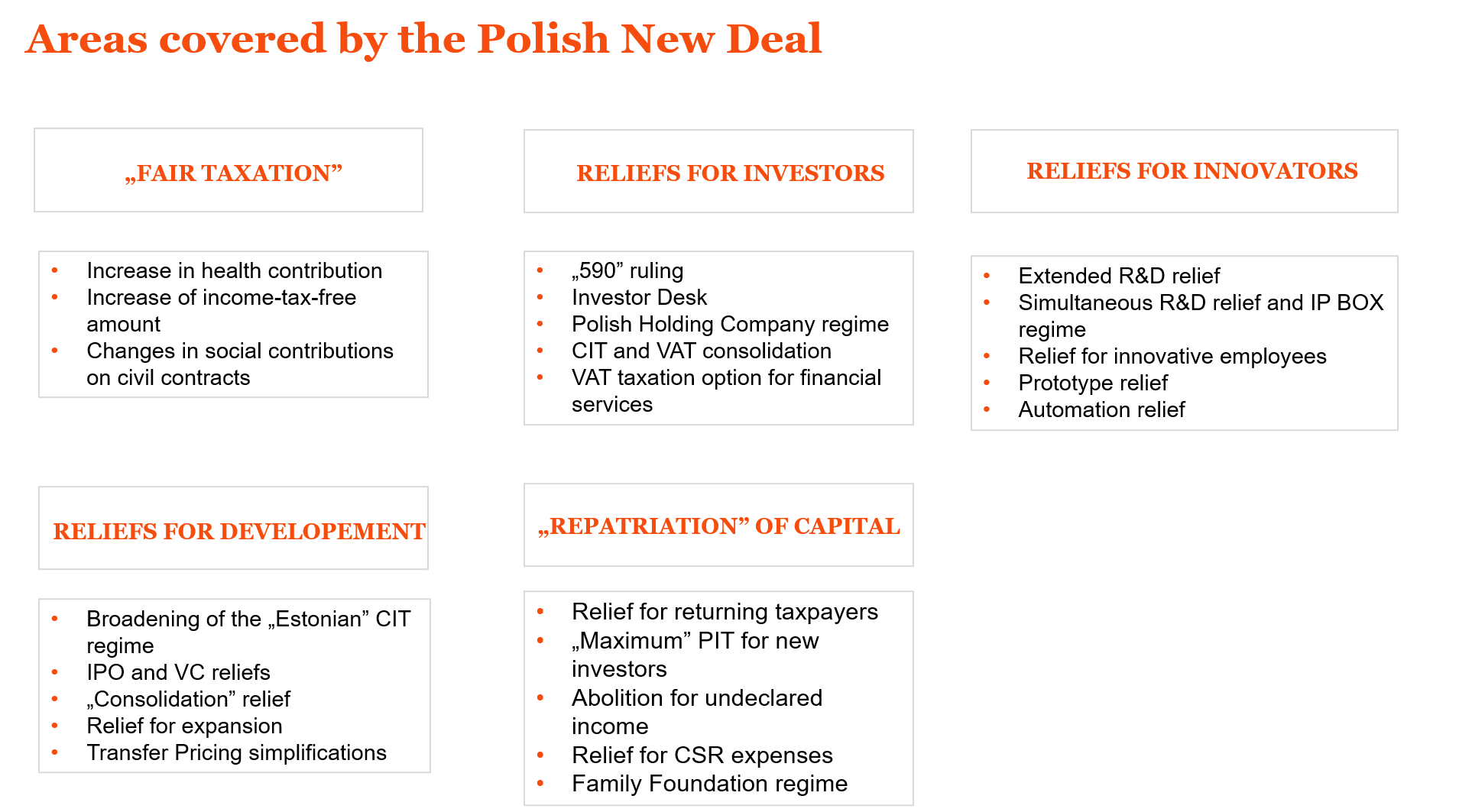

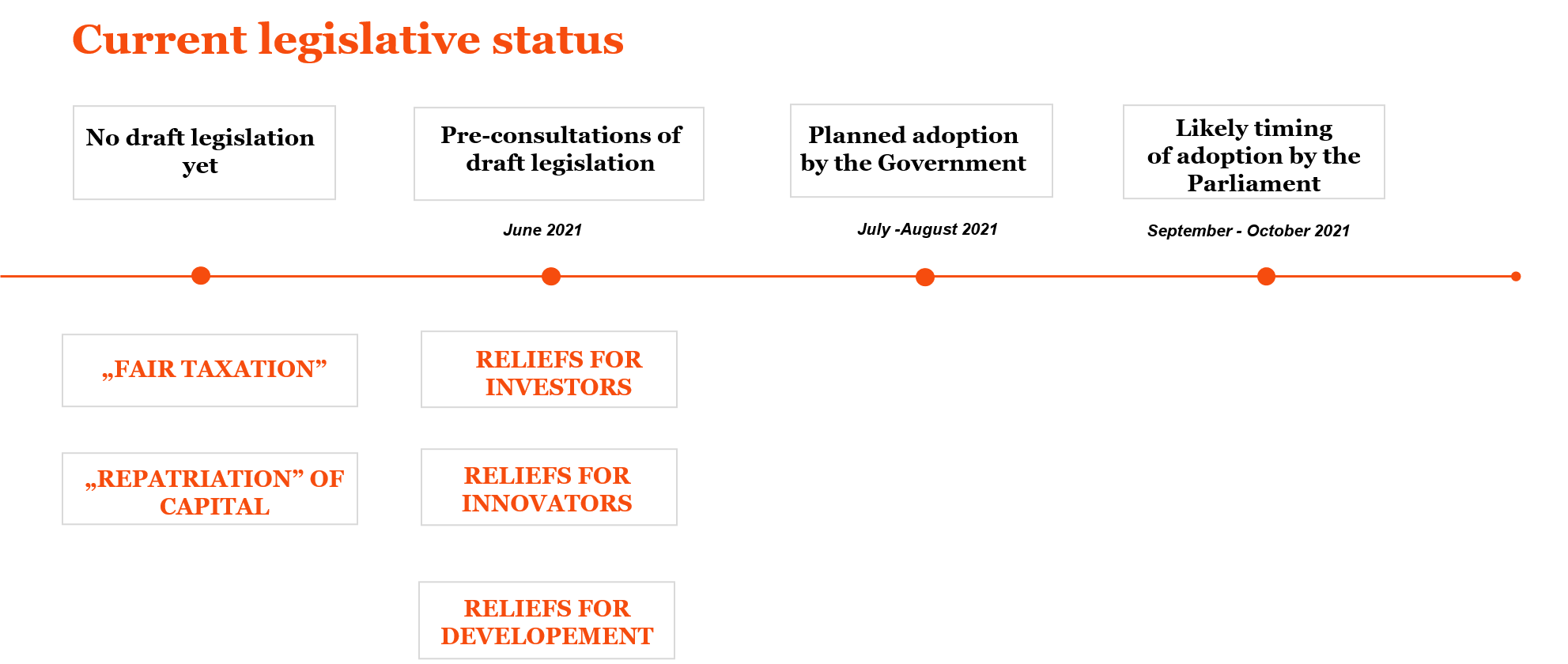

#PolishNewDeal: new instruments to enhance investment in Poland

The Polish New Deal’s goal – at least on a narrative level – is aimed at increasing the attractiveness of the Polish tax system for investors. The “Investor” package includes: (i) Investment Agreement, (ii) set-up of an Investor Desk, (iii) certain new options for tax consolidation, (iv) introducing a Polish Holding Company Regime and (v) VAT taxation option for financial services.

“Ruling 590” (Investment Agreement) and “Investor Desk”

The “Ruling 590” concept fits into the “co-operative compliance” approach promoted by the MoF. In fact, it would have the form of an agreement, concluded between the MoF and a so-called “strategic investor”. Key features of this instrument are as follows:

- The agreement with the investor would be valid for five years; however it will expire in case of change of legislation should it become incompliant with the new law;

- A “strategic investor”, i.e. an investor that plans to start / has started a new investment meeting minimum value thresholds:

- PLN 100 m (approx. EUR 23m) till 31.12.2024

- PLN 50 m (approx. EUR 11.5m) after 1.01.2025

- There will be a possibility for renegotiation and extension of the validation date;

- Initial fee approx. EUR 12k + final fee, from approx. EUR 23k up to approx. EUR 116k (lower fees for amendment)

- Ruling 590 could cover four existing security instruments, i.e.:

- Individual interpretation

- GAAR opinion

- Binding VAT rate/excise information

- Advance Pricing Agreements (APA)

Ruling 590 will not however cover – at least at this stage – the security opinion on application of the WHT exemption.

As for the Investor’s Desk, its main goal is that the service of key investments will be handled by the MoF, taking care of work coordination and an appropriate level of service.

Tax Consolidation for VAT and CIT purposes

VAT groups although popular in the EU (which exist in 18 EU countries) are currently not available in Poland. The Polish New Deal is about to introduce them as of 1 January 2022 on a voluntary basis. The main advantage of the VAT group regime covers no intra-group invoices and preparation of one JPK_VAT (SAF-VAT) for the whole group, but primarily achieving financial benefits in case of different VAT positions of the group members.

The Polish New Deal also contains certain solutions that loosen current requirements for CIT tax consolidation under Tax Consolidation Group provisions:

- Reduction of the minimum share capital to EUR 60k

- No requirement to maintain a minimum profitability ratio for the TCG

- Slightly more complex structures could be allowed under the TCG regime

- Some additional possibilities of recognising pre-TCG loses

Polish Holding Company Regime

Another novelty covered by the Polish New Deal are the provisions setting up the Polish Holding Company (PHC) Regime. The key tax benefits of the PHC would cover exemption of inbound dividends up to 95% and a capital gains exemption. The following conditions must however be met jointly:

- A PCH is set up as a limited company or joint-stock partnership, holding min. 10% of shares for one year in a subsidiary (domestic or foreign)

- Its direct / indirect shareholder is seated in a "good" jurisdiction (non-tax heaven, DTT with Poland, allowing for exchange of information concluded)

- Not a Tax Consolidation Group company

- It does not benefit from tax exemptions

- It runs a genuine business activity

Further requirements concern a subsidiary of a PHC, in particular it is a limited company or joint-stock company, not a TCG member, does not own more than 5% of shares in other companies, and is not a partner in a non-legal entity.

Application of the capital gains exemption will be preceded by submitting the specific declaration 30 days before the disposal. Exemption will not be available for the disposal of shares in a subsidiary whose assets are in the majority directly or indirectly consisting of real estate located in Poland.

VAT taxation option for financial services

Similar to eight other EU countries, Poland also plans to introduce a VAT taxation option for financial services. The option would be limited to B2B trade, i.e. excluding consumer transactions, and also excluding insurance services. It is not clear if the option is on an “all or nothing” basis or can be applied to selected services only.

In practice, application of the VAT option may bring savings for the financial sector through increased proportion of VAT deduction.

Listen