Preparing TPR-C is easy with our Easy TPR-C’rido Tool

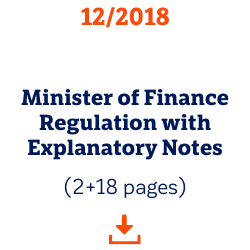

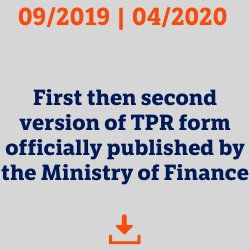

2019 brought another change to the transfer pricing regulations that impose even more detailed transfer pricing reporting obligations on taxpayers, as compared to previous years. One of the biggest challenges in 2020 is to report the transfer pricing information to the Head of the National Revenue Administration via the TPR-C form (TPR-P for personal income tax) for FY2019. The obligation to submit the TPR form was imposed by the CIT Act followed by the executive Minister of Finance Regulation on transfer pricing information announced in December 2018.

An explanatory memorandum to the Regulation indicates that the transfer pricing information has a “simplified and transparent form” and that submitting it in electronic form based on the XML schema “will allow for a significant reduction in the time needed to fill in the information, as well as increase its transparency and significantly simplify the process of filling in the information itself“.

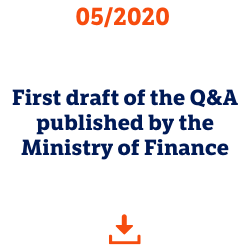

The Regulation itself is short – it is in fact only 2 pages long, but the explanatory notes issued with it have 18 pages. However, both documents do not give sufficient guidance to taxpayers on how to submit the information. Hence in May 2020 the Ministry of Finance published a preliminary version of the Questions and Answers, which are supposed to dispel the taxpayers’ doubts. The Q&A document is already 36 pages long and has been subject to public consultation, so the next version may be even more extensive.

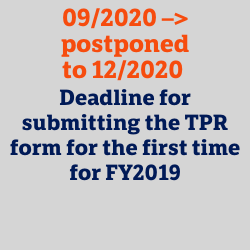

Despite these few documents explaining the TPR form, it still arouses a lot of controversy, and once the taxpayers start filling it in, further questions and doubts arise. And the deadline for reporting, although postponed, is inevitably approaching.