What does it mean?

A number of changes introduced by the Polish New Deal in the area of company reorganizations will negatively impact the certainty regarding tax consequences of such operations. In particular in order to ensure their neutrality, it may be necessary to analyse the history of operations performed on the shares held.

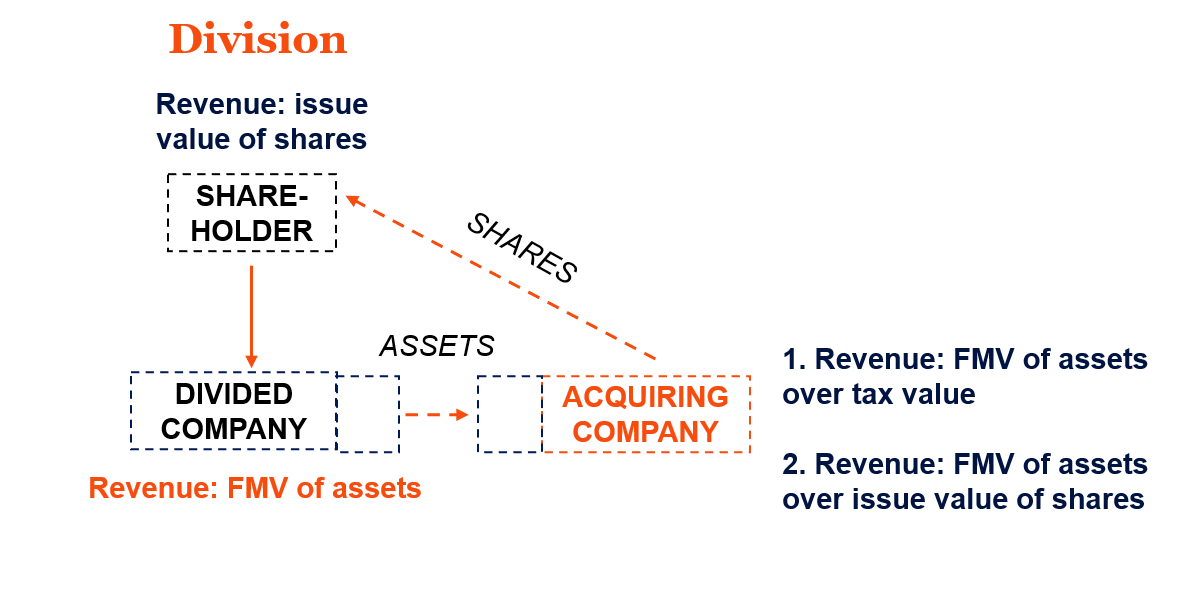

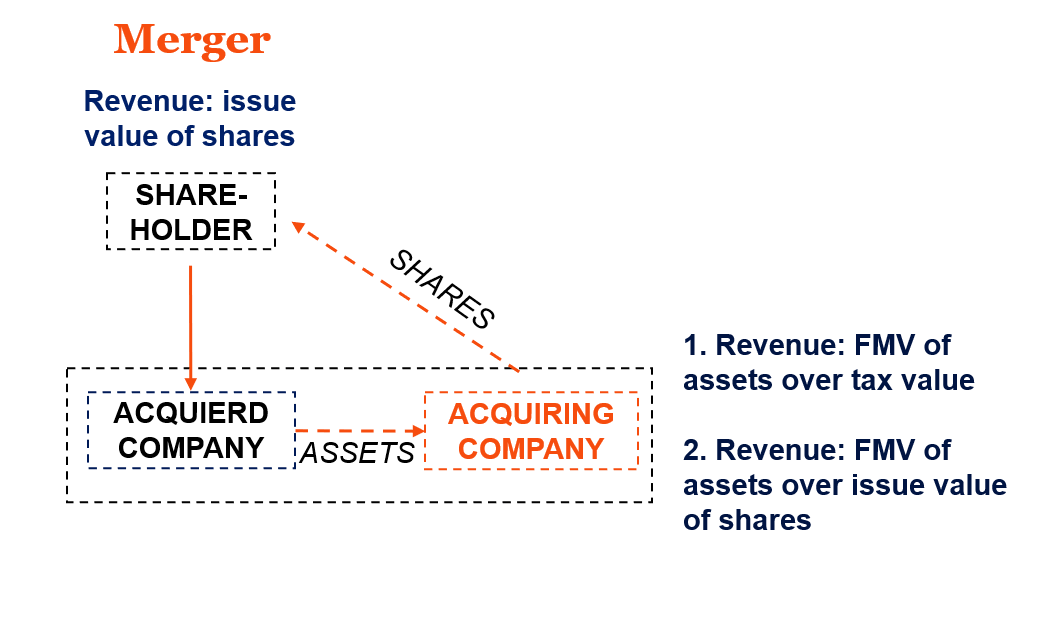

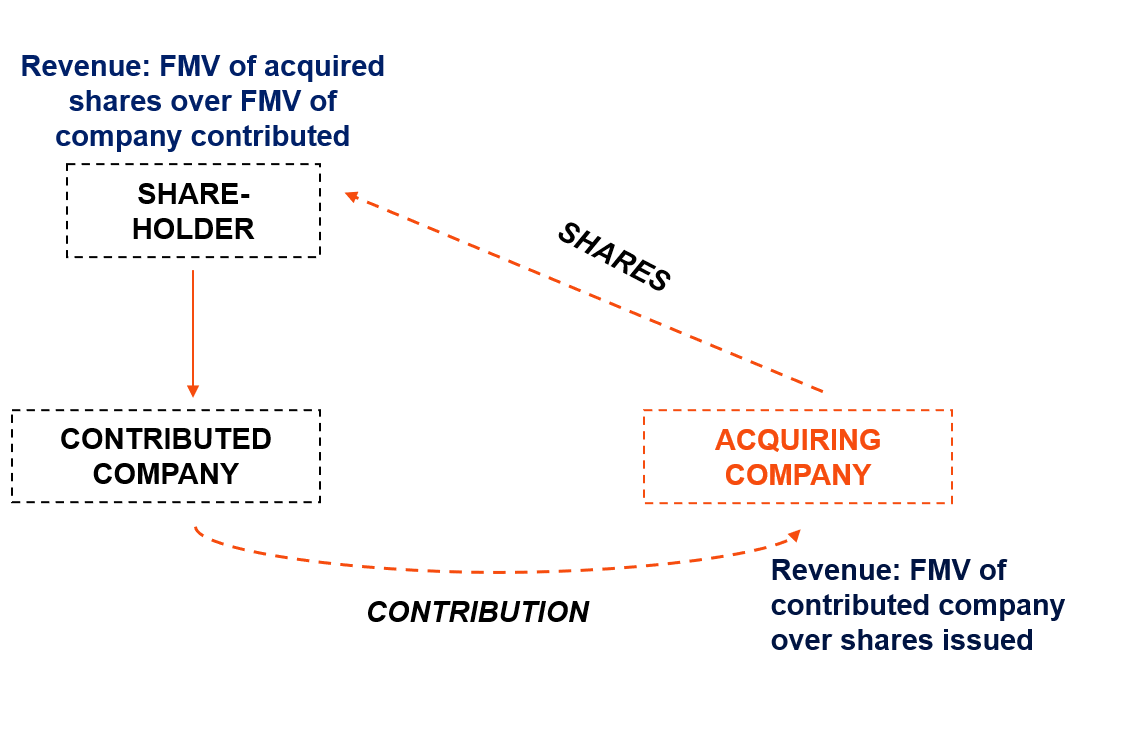

New regulations on taxation of exchanges of shares, mergers and demergers – new definition of income and conditions of tax neutrality.

Exchange of shares

- neutrality for shareholder when shares disposed were not previously acquired by means of another share exchange, merger or demerger (neutrality rule for the first reorganization only)

- tax value of shares in acquiring company acquired by shareholder is not higher than tax value of shares in the company contributed if the contribution had not been made

- acquisition from the same shareholder within maximum 6 months (contrary to MF’s general advance ruling and administrative courts)

Mergers

Shareholders of acquired companies:

- Neutrality when shares of acquired / divided company were not previously acquired by means of another share exchange, merger or demerger (neutrality rule for the first reorganization only)

- tax value of shares of acquiring company is not higher than tax value of shares in acquired company if the merger / demerger had not taken place

Acquiring companies:

- obligation to continue tax valuation of acquired assets

- obligation to allocate acquired assets to business activity in Poland

- cross-borders mergers with non-Polish acquiring company – neutrality when assets are allocated to business activity outside Poland.