What's going to change?

Polish New Deal will bring a number of changes also in the field of flat rate on income of companies (the so called “Estonian CIT”) – a simplified method of taxation in which tax is generally paid at the time of distribution of profits by the company, and tax is calculated on the basis of accounting results. This tax effective regime is in general available for simple shareholdering structures, with natural persons holding all of the shares / equity in the taxpayer.

The most important changes in Estonian CIT include:

- extension scope of application flat rate to: simple joint-stock companies, limited joint-stock partnerships, limited partnerships (currently “Estonian CIT” is available only to companies operating as limited liability companies and joint-stock companies)

- liquidation of limit of revenues (currently the limit is set at PLN 100 million per year – including VAT)

- abolition of the obligation to incur capital expenditures for fixed assets

- no obligation to pay the entry tax resulting from the change from the tax result to the accounting result – provided that the company remains in the flat rate taxation for 4 years

- the manner of calculating tax on transformation is also changed – tax will be calculated as the difference between accounting value (instead of market value) and tax value of assets

- the possibility of entering Estonian CIT during the year is explicitly included in the regulations

- lowering of flat rates:

- 10% of the tax base (currently 15%) – in the case of small taxpayers

- 20% of the tax base (currently 25%) – in case of a taxpayer other than specified above

- changes in the scope of termination of the flat rate taxation:

- as a consequence of the above changes, a premise of the loss of the right to a flat rate taxation as a result of not incurring capital expenditures and exceeding the limit of PLN 100 million will be abolished

- if a taxpayer gives up the right to a flat rate, the taxpayer’s flat rate taxation ends at the end of the tax year in which the taxpayer gives up the right

- changes in the scope of exiting the Estonian CIT – no obligation to pay tax until the distribution of the retained profit generated during the flat rate taxation

- liquidation of the institution of the additional tax (which is the result of the abolition of the income limit)

What does it mean?

The revision of the Estonian CIT will introduce several favorable changes for taxpayers who choose to tax their income in the form of a flat rate on income of companies.

In particular attention should be paid to aspects such as:

- Estonian CIT will become available to broader group of taxpayers – to all companies taxed with CIT, in addition, they will not be limited by maximum amount of revenue

- no obligation to incur capital expenditures– Estonian CIT will be open for more companies (not only capital-intensive)

- easier entry – possibility to avoid tax on entry and in general more preferable taxation of transformation

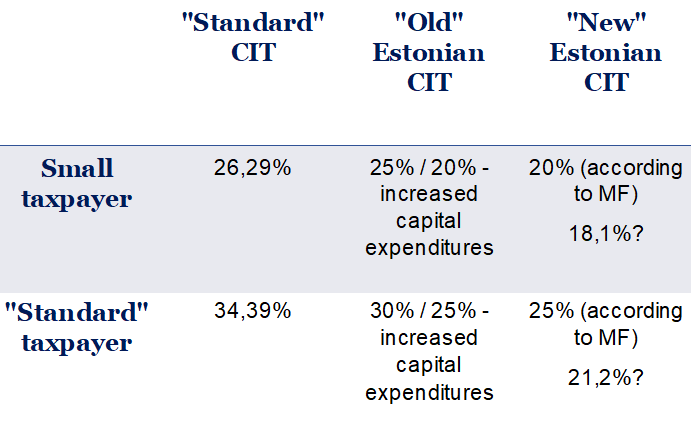

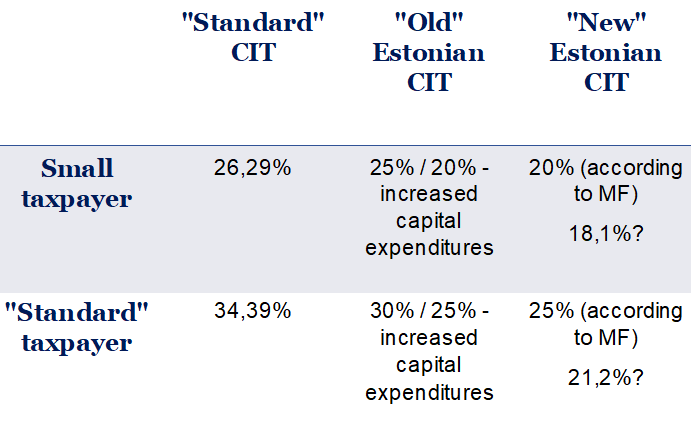

- lower effective tax rate:

- easier exit – deferred payment of tax until distribution of profits to partners

- tax calculations based on accounting books, no tax accounting

- no obligation to report domestic tax schemes (MDR)

- no minimal revenue tax for taxpayers who have chosen this method of taxation