What does it mean?

The introduced changes may result in increasing of the CIT effective tax rate.

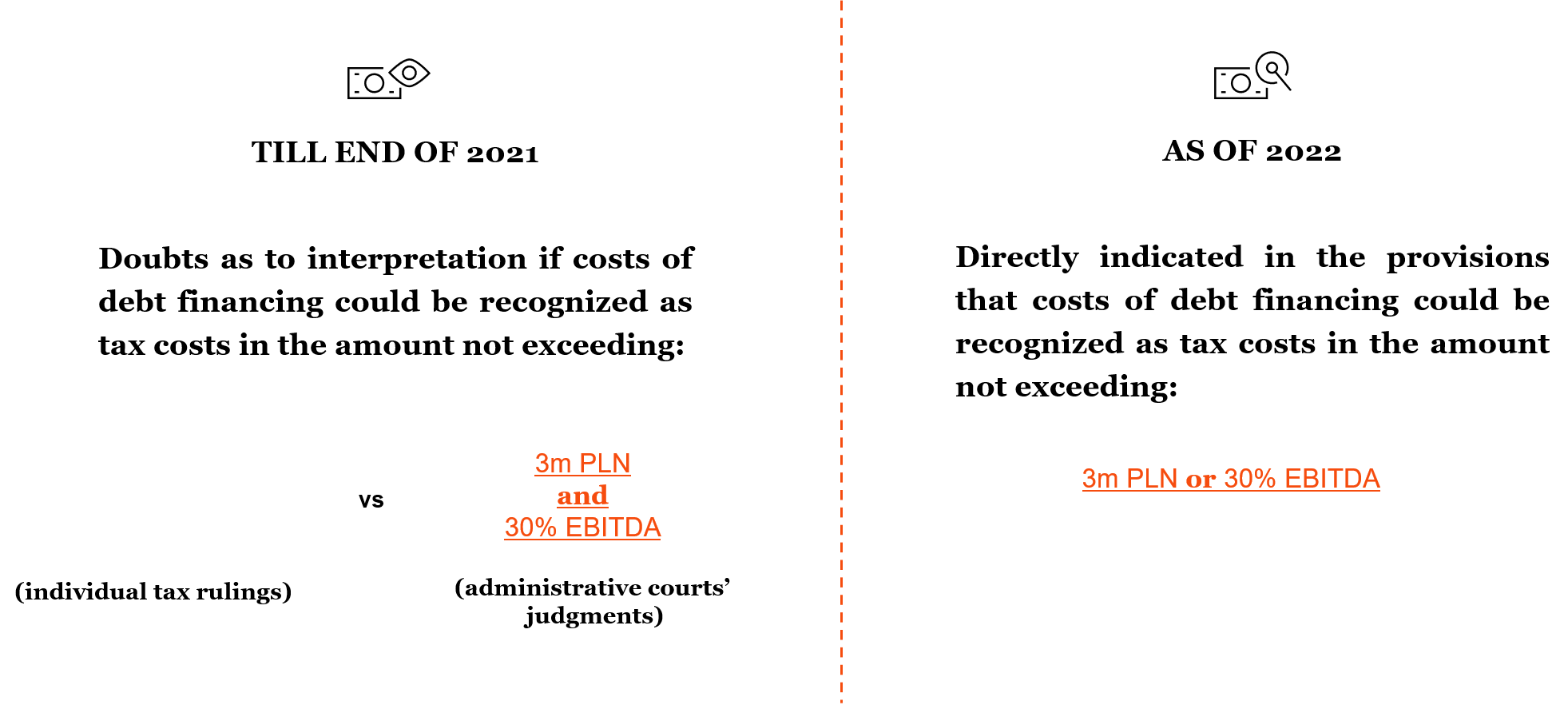

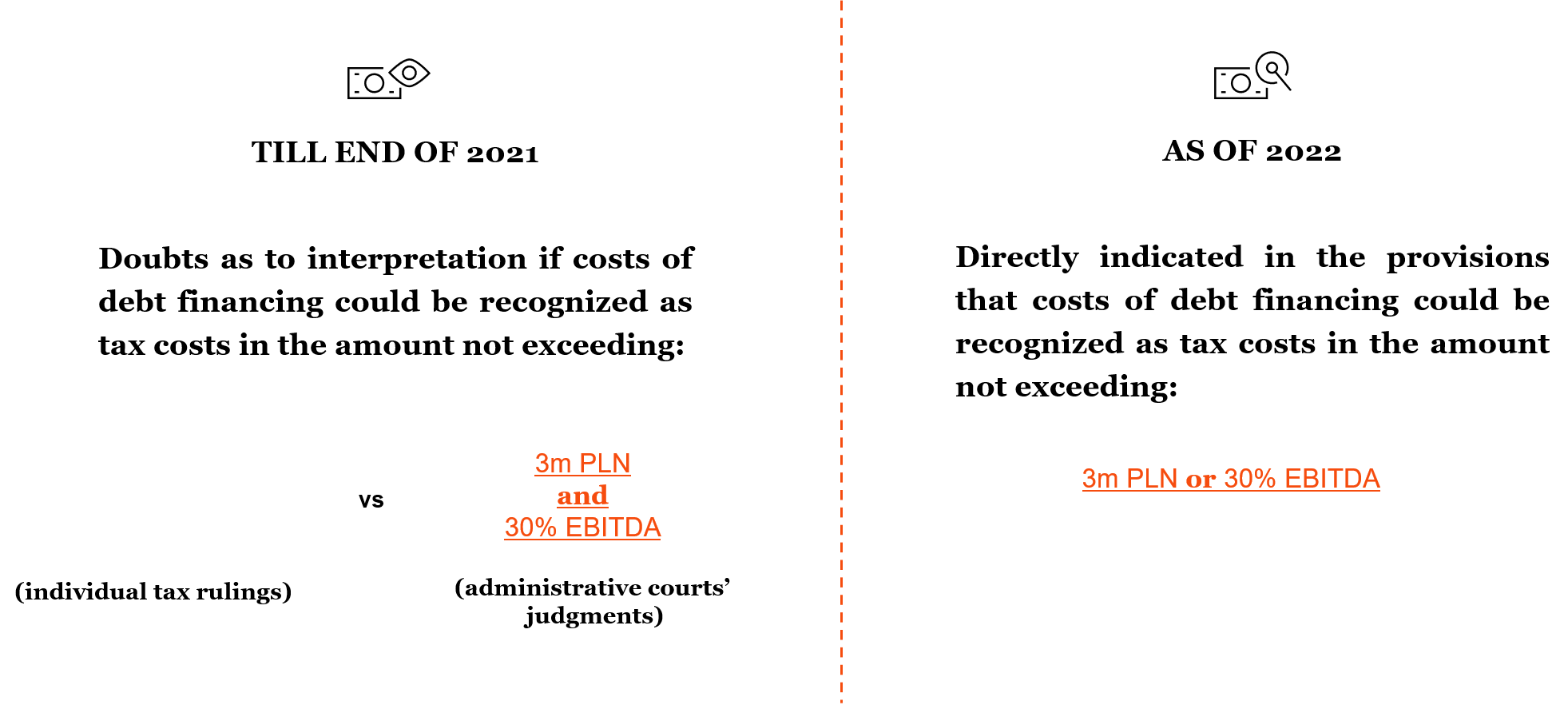

The Polish New Deal introduces additional limitations on tax deductibility of the costs of debt financing, namely:

Due to lack of grandfathering rules, new regulations may also concern debt financing costs resulting from financing granted before 1 January 2022.

The introduced changes may result in increasing of the CIT effective tax rate.

Within the scope of our services we can:

Thank You

Your message has been sent.

Contact us

Latest news