Regional aid map

Other calculation rules for projects above EUR 50 million of eligible costs

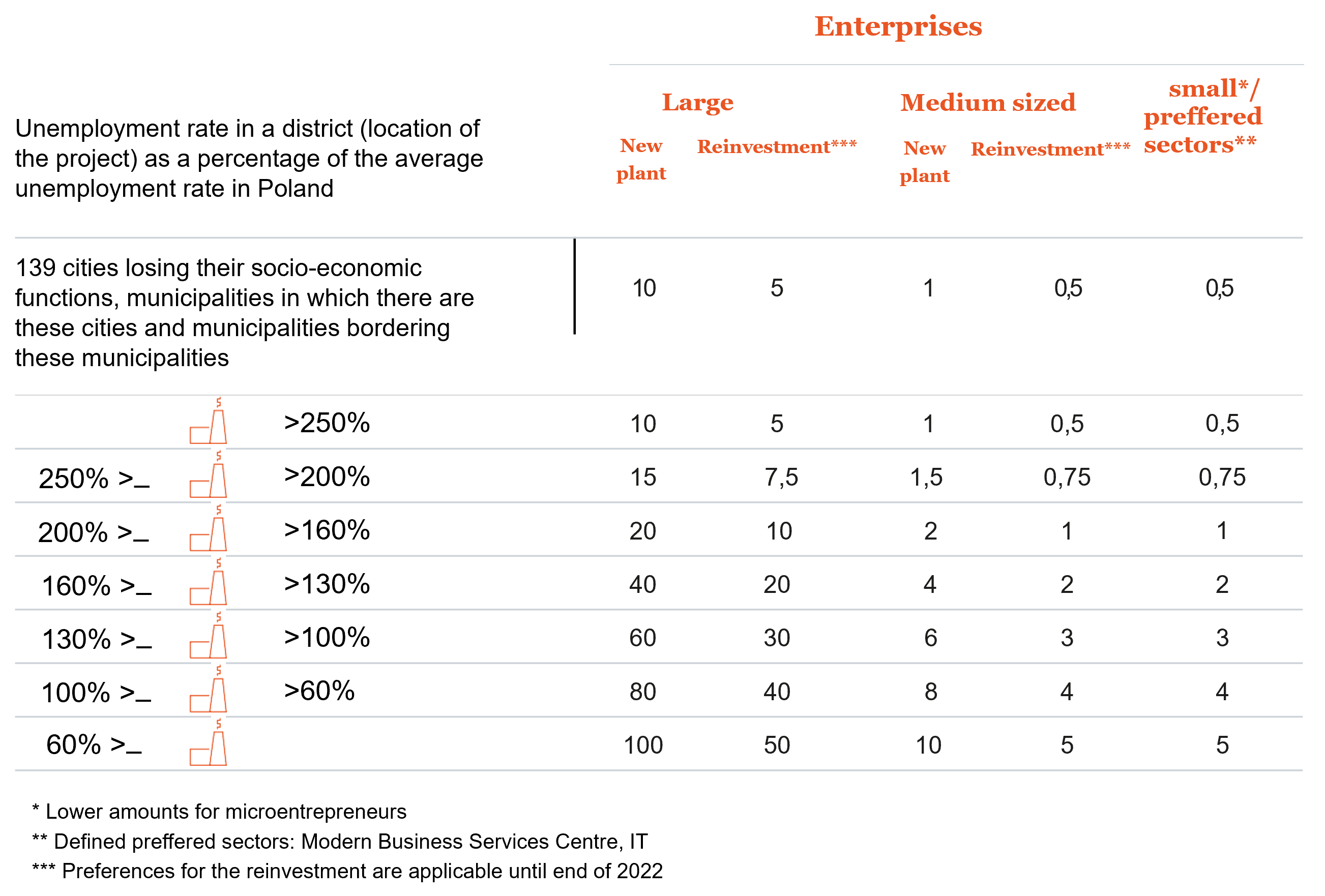

As part of the Polish Investment Zone entrepreneurs from all over the country can apply for support for investment projects. Co-financing is in the form of income tax exemption (CIT / PIT) in the amount of up to 70% of the value of the investment. To be able to take advantage of the exemption, you must obtain the so-called decision on support (DoW), which at the entrepreneur’s request is issued by the managers of the relevant Special Economic Zone.

CRIDO services

Polish Investment Zone | Conditions for receiving support and levels of support

The exemption limit is calculated as a percentage of the eligible costs of the new investment. The entrepreneur has 10, 12 or 15 years to use the tax exemption.

Other calculation rules for projects above EUR 50 million of eligible costs

Towns in terminal social and economic decline, areas where such towns are and areas adjacent to those areas | Lowest possible entry threshold

1. Bolesławiec

2. Bielawa

3. Dzierżoniów

4. Głogów

5. Jawor

6. Kamienna Góra

7. Kłodzko

8. Nowa Ruda

9. Lubań

10. Jelenia Góra

11. M. Legnica

12. Wałbrzych

13. Świdnica

14. Świebodzice

15. Ząbkowice Śląskie

16. Zgorzelec

17. Złotoryja

1. Chełmno

2. Inowrocław

3. Grudziądz

4. Nakło nad Notecią

5. Rypin

6. Włocławek

7. Świecie

1. Biłgoraj

2. Hrubieszów

3. Krasnystaw

4. Kraśnik

5. Lubartów

6. Łuków

7. Biała Podlaska

8. Chełm

9. Zamość

10. Radzyń Podlaski

11. Tomaszów Lubelski

1. Międzyrzec

2. Nowa Sól

3. Żagań

4. Żary

1. Kutno

2. Łask

3. Opoczno

4. Radomsko

5. Sieradz

6. Tomaszów

7. Mazowiecki

8. Wieluń

9. Zduńska Wola

10. Ozorków

1. Chrzanów

2. Gorlice

3. Nowy Sącz

4. Nowy Targ

5. Tarnów

6. Zakopane

1. Ciechanów

2. Gostynin

3. Kozienice

4. Ostrołęka

5. Ostrów Mazowiecka

6. Pułtusk

7. Radom

8. Sierpc

1. Brzeg

2. Kędzierzyn-Koźle

3. Kluczbork

4. Krapkowice

5. Namysłów

6. Nysa

7. Prudnik

8. Strzelce Opolskie

1. Dębica

2. Jarosław

3. Jasło

4. Krosno

5. Mielec

6. Nisko

7. Przemyśl

8. Przeworsk

9. Sanok

10. Stalowa Wola

11. Tarnobrzeg

1. Augustów

2. Bielsk Podlaski

3. Grajewo

4. Hajnówka

5. Łomża

6. Sokółka

7. Zambrów

1. Bytów

2. Chojnice

3. Lębork

4. Słupsk

5. Malbork

1. Bytom

2. Jastrzębie-Zdrój

3. m. Piekary Śląskie

4. m. Siemianowice

5. Śląskie

6. Sosnowiec

7. Świętochłowice

8. Zabrze

9. Rydułtowy

10. Zawiercie

1. Busko-Zdrój

2. Jędrzejów

3. Końskie

4. Ostrowiec Świętokrzyski

5. Sandomierz

6. Skarżysko-Kamienna

7. Starachowice

8. Staszów

1. Bartoszyce

2. Braniewo

3. Działdowo

4. Ełk

5. Giżycko

6. Iława

7. Kętrzyn

8. Lidzbark Warmiński

9. Elbląg

10. Mrągowo

11. Olecko

12. Ostróda

13. Pisz

14. Szczytno

1. Chodzież

2. Gniezno

3. Koło

4. Konin

5. Piła

6. Pleszew

7. Turek

8. Złotów

1. Białogard

2. Choszczno

3. Gryfice

4. Stargard

5. Szczecinek

6. Świdwin

7. Wałcz

The criteria that an industrial design and a service design must meet are slightly different. In the case of the industrial sector, the entrepreneur can choose from 13 criteria, broken down into the criteria of sustainable social development (8 items) and sustainable economic development (5 items). In the case of the service sector, the list includes 12 items (criteria of sustainable social development – 7 items and sustainable economic development – 5 items). In both cases, it is necessary to meet a total of 4, 5 or 6 criteria (depending on the region of the investment implementation).

List of quality criteria

Sustainable economic development criteria:

• Investment in projects involving supply of services supporting industries in line with the current development policy of the country or with smart specializations of the voivodeship

• Using the potential of human resources.

• Establishing regional links.

• Robotization and process automation

• Belonging to the National Key Cluster

• Conducting research and development activities

• New investment in renewable energy sources

• Status of a micro-entrepreneur, small entrepreneur or medium-sized entrepreneur

Sustainable social development criteria:

• Creation of specialized jobs

• Running a business with a low negative impact on the environment

• Location of the investment project

• Supporting the acquisition of education and professional qualifications

• Measures enhancing employee welfare

Sustainable economic development criteria:

• Investment in projects involving supply of services supporting industries in line with the current development policy of the country or with smart specializations of the voivodeship

• Conducting research and development activities,

• Using the potential of human resources

• Establishing regional links.

• Robotization and process automation

• New investment in renewable energy sources

• Status of a micro-entrepreneur, small entrepreneur or medium-sized entrepreneur

Sustainable social development criteria:

• Creation of high-paid jobs and offering secure employment,

• Running a business with a low negative impact on the environment

• Location of the investment projects

• Supporting the acquisition of education and professional qualifications

• Measures enhancing employee welfare

The Polish Investment Zone has been operating in its present form since 2018 (previously, there were Special Economic Zones for over 20 years). The legal basis for PSI is the Act on Supporting New Investment of May 10, 2018 and implementing acts passed in connection with this act, including the amended provisions on the Polish Investment Zone, which came into force on January 1, 2022.

So far, CRIDO experts have obtained over PLN 1.9 billion in tax exemptions for investment projects worth around PLN 6.4 billion.

Our experts regularly conduct training sessions for entrepreneurs during which they share knowledge about support under the Polish Investment Zone rules and other issues related to state aid, law and taxes. So far, we have organized such meetings in cooperation with the Wałbrzych SEZ, Legnica SEZ, Katowice SEZ, Starachowice SEZ, Pomeranian SEZ, ARP in Mielec and the Life Science Cluster in Krakow.

Thank You

Your message has been sent.

Contact us

Latest news