Indexation rates in a commercial lease agreement - how best to protect your interests?

The problem of high inflation

The beginning of the year is a time when the provisions of many commercial lease agreements authorize landlords to valorize rental rates. In the face of inflation, which is unprecedentedly high for the last dozen years in Poland and in the rest of the European Union as well, and the related significant increase in the costs of conducting business activity, the subject of rent valorization, and in fact what index will be applied in the lease agreement, is of key importance for both landlord (aiming to maintain the purchasing power of the rent received) and tenant (seeking to minimize costs).

Denomination of rent in PLN and EUR

The annual average consumer price index published annually by the President of the Polish Central Statistical Office is generally applicable for rents expressed in Polish zloty, but for commercial buildings in Poland (offices, warehouses, etc.) rents are generally expressed in euro, which is caused by the need to avoid exchange rate risk resulting from the fact that these investments are mainly financed in euros. Moreover, the rent denominated in euro allows such a building to be valued more favorably on the capital market as an investment product.

What indicator is used for rents in EUR?

When indexing euro-denominated rents, it is common practice to use a set of indicators known as Harmonised Indices of Consumer Prices (HICPs) published by Eurostat, the European Statistical Office of the European Communities.

HICPs are generally divided into the month-to-month indices (M/M-1), the indices relative to the corresponding month of the previous year (M/M-12), or the annual average indices. They are calculated for a given geographical area, i.e. separately for: the European Union member states that have adopted the euro (the Monetary Union index of consumer prices - MUICP); all European Union member states altogether (the European index of consumer prices - EICP); the EEA excluding Liechtenstein (the European Economic Area index of consumer prices - EEAICP); each European Union member state individually; and selected countries outside the European Union.

At the same time, HICPs are prepared, inter alia, for: the general basket of consumer prices of selected services and products (all items); the aforementioned basket without energy prices; the aforementioned basket without energy prices and unprocessed food; the aforementioned basket without energy prices, food, alcohol, and tobacco products; or separately for food prices, transport, clothing sector, housing, etc.

Which HICP is most commonly used?

Research conducted by Crido's lawyers shows that the most commonly used type of HICP used in commercial lease agreements in Poland is the MUICP, followed by the EICP. In both cases, the most commonly used is the annual average all items index, but there are also all items indices calculated regarding the relevant month of the previous year, most often January or, more rarely, September or the month in which the given lease agreement was concluded.

It is also not uncommon to find in lease agreements the provisions introducing a minimum and maximum value for the valorization index (so-called cap), as well as an exclusion of negative valorization. Often, contracts describe the index by stating a specific number of countries that are members of the European Union or members of the eurozone. This practice raises a significant interpretive problem when the number of these countries changes and the given index is no longer published. It is then uncertain which index to use or whether to use any index at all. Therefore, it is recommended that the wording of such index should be, for example, as follows: the EU HICP (Harmonised Index of Consumer Prices) published by Eurostat - the Statistical Office of the European Communities for countries belonging to the European Union at the time of valorization, or should indicate which of the parties to the lease agreement will select a new index for rent valorization as well as the procedure for this selection.

Which HICP best protects the interests of the landlord and the tenant?

Statistics over the last 10 years show that inflation in the eurozone has been slightly lower than in all EU countries altogether. Nevertheless, these differences were significantly greater during the time of the pandemic and the crisis caused by the war in Ukraine, i.e. averaging 0.44% in 2020, 0.3% in 2021, and 0.8% in 2022 respectively. This makes the MUICP index, as the basis for calculating the valorization, more favorable from the tenant's perspective than the EICP, whilst as a consequence, the EIPC is better for the landlord.

In addition, the use of an index calculated by reference to the relevant month of the previous year makes it necessary for both the tenant and the landlord to accept the risk that the rent will be valorized based on an index value underestimated or overestimated compared to the average annual index.

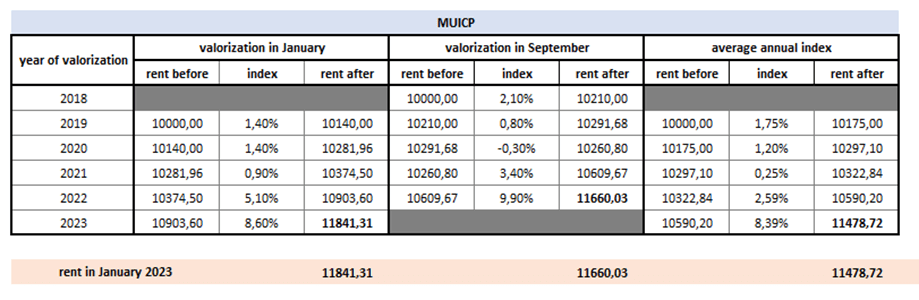

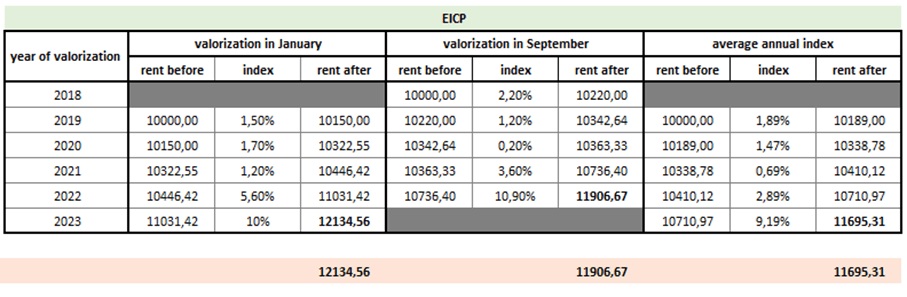

The tables below show how much the rent would be in January 2023 for a lease agreement concluded at the beginning of 2018 with a rent set at €10,000 if the valorization was based on either the MUICP or EICP all items index in the form of the average annual index or calculated concerning the corresponding month of the previous year, i.e. either January or September. It was assumed that in the latter case the first valorization took place in September 2018, and the first two cases in January 2019.

The above 5-year data, covering a period of both low and very high and volatile inflation, shows that the most favorable version of the index for the landlord during this period was the EICP calculated year-on-year for the month of January, whilst for the tenant, it was the MUICP based on the average annual index. Furthermore, the rent calculated regarding the corresponding month of the previous year for either January or September was overvalued in January 2023.

Listen