The Polish New Deal – the Polish government presents some key tax points for post COVID-19 recovery

On 15 May, the Polish governing party presented a plan called the Polish New Deal which is designed to map out a post-pandemic recovery of Poland. The plan – along with an over 90-page document – is intended to be pro-social, outlining a number of reforms to provide aid to the Polish healthcare system and more support for low-income families. The program includes certain tax measures which – if introduced – may lead to increased costs of employment and conducting business activity in Poland, in particular for employees and self-employed.

Key changes for employees and entrepreneurs include:

- Introducing a 9% health contribution, proportional to income, without its tax deductibility, which would result in a significant tax rise, especially for self-employed (now paying health insurance contributions regardless of their income of approx. EUR 80 / month). This change will also increase the employment cost, in particular for employees earning over PLN 12 k (approx. EUR 3 k) per month.

- Increase of income-tax-free amount from PLN 8 k up to PLN 30k (approx. EUR 6.6k), and the threshold for the second 32% PIT bracket, from PLN 85 k to PLN 120 k (approx. EUR 26,400) per year. These changes aim to mitigate the negative impact of the health contribution increase.

- New relief in personal income tax (PIT) for employees working under employment contracts with an annual income between PLN 70-130k (details of the relief are not known, it is said however it will be calculated based on a special algorithm).

- Measures aimed at lowering the attractiveness of use of civil contracts, in particular introducing full social security contributions for order contracts.

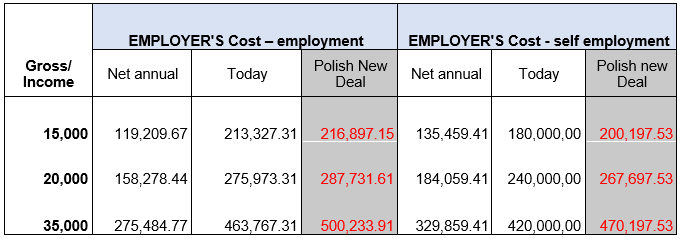

The below table shows the increase of employer costs under the Polish New Deal (in rough numbers, all amounts in PLN).

Other measures announced cover:

- Relief package for innovative businesses including:

- relief for prototypes

- relief for automation and robotization of the production process

- simultaneous use of R&D relief and the IP BOX regime

- tax advantages for employers hiring “innovative” workers

- A new instrument (the so-called “590 Ruling”), granted to so-called strategic investors to secure tax consequences of the investment in Poland

- Broadening the scope of so-called “Estonian CIT” (a regime under which profits are not taxed until distributed, currently applicable only to a narrow group of companies)

- Introduction of tax grouping for VAT purposes

- Simplifications in the area of TP for holdings (not specified)

- CIT consolidation relief (not specified)

- VAT option for financial transactions

- Elimination of tax barriers for VC financing

The total cost of the program is estimated at PLN 651.6bn in the years 2021-2030. The exact timing for the introduction of the changes is not known yet. However, the Ministry of Finance intends that the draft legislation will be discussed in the Parliament early autumn 2021 with its introduction as of January 2022. This leaves some space to plan ahead, especially to verify the impact of the changes on the current employment model.

Listen